Which Analyst Is the Best on Predicting the Earnings

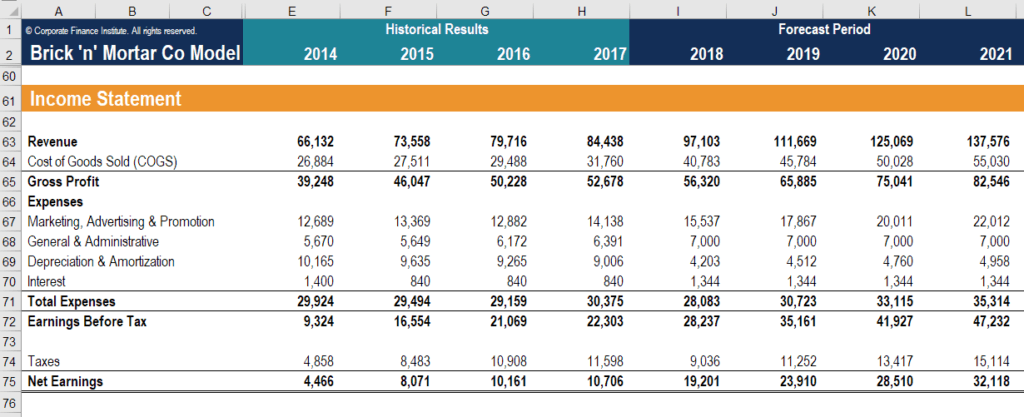

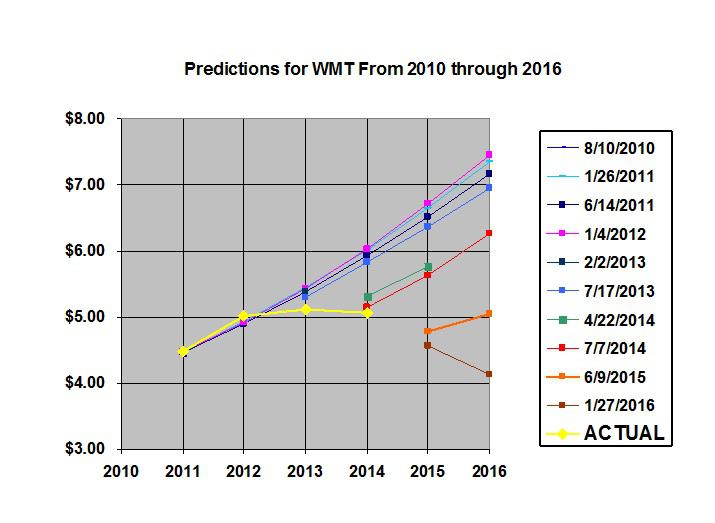

This model will usually contain every line item of a companys financial statements over the past five to ten years. Earnings ESP Expected Surprise Prediction is a potent tool that investors can use to select better stocks for their portfolios.

Financial Forecasting Guide Learn To Forecast Revenues Expenses

He estimates the following regression using 30 large firms.

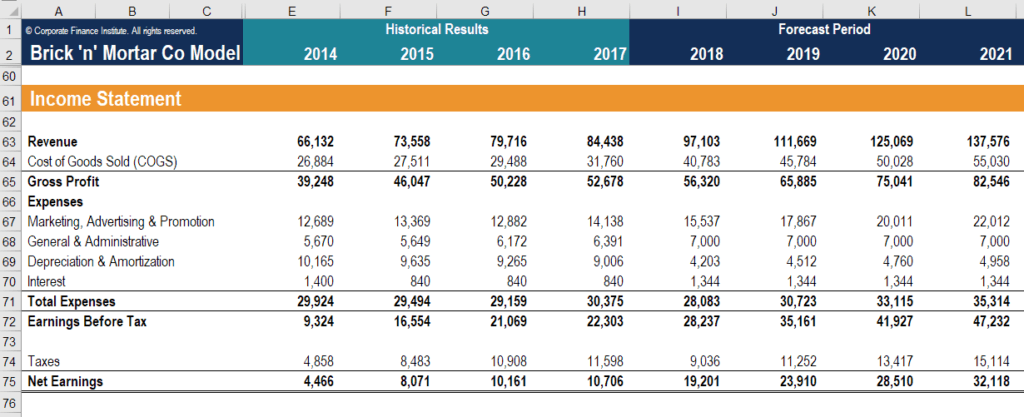

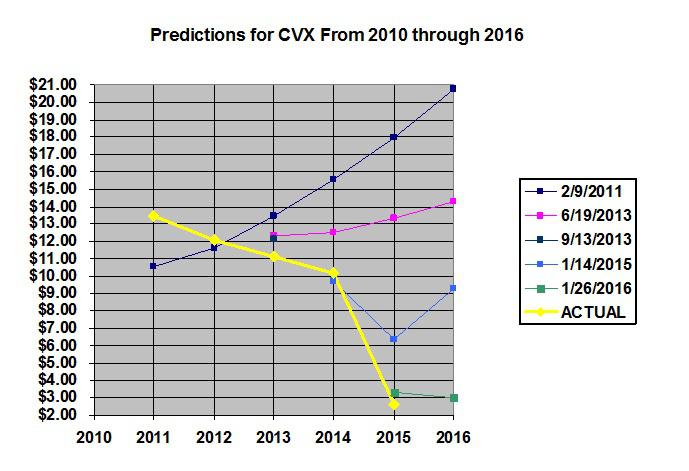

. Answer 1 of 2. To predict earnings most analysts build financial models that estimate prospective revenues and costs. Analysts Do A Great Job Predicting The Past.

Our evidence suggests that earnings expectations are decision useful where the decision context is sell-side analysts stock price forecasts. Many analysts will incorporate top-down factors such as economic growth rates. 1 hour agoNewmont Corp.

10 hours agoThe company reported 026 earnings per share EPS for the quarter. Furthermore in the past year his picks generated an alpha of 9 over the SP 500 index and. Similarly TW has 3183 upside from the recent share price of 7908 if the average analyst target price of 10425share is reached and analysts on average are expecting RNR to reach a target.

Define FRCSTiat as a revised forecast of EPS for. Predicting Individual Analyst Earnings Forecasts 31 THE MODEL AND METHOD FOR PREDICTING FORECASTS I use publicly available information released since the date of an analysts current forecast to predict his next forecast. The Zacks Consensus Estimate for the quarters earnings and.

Top-Rated Stocks Near Buy Point Ahead Of Earnings. Donaldson earnings in the three-month period ended April 30 rose 18 percent to 46 cents per share on a 9 percent sales gain to 647 million. A financial analyst believes that the best way to predict a firms returns is by using the firms price-to-earnings ratio PE and its price-to sales ratio PS as explanatory variables.

10 hours agoAnalysts Offer Predictions for AcuityAds Holdings Incs FY2022 Earnings TSEAT Posted by MarketBeat News on Apr 25th 2022 Share on Twitter Share on Facebook Share on LinkedIn Share on Stocktwits. Most analysts start with an in-depth financial model in Microsoft Excel. Assume the current day is day t - 1.

Earnings estimates come from brokerage firm stock analysts. The third and last step in analyzing options to make earnings predictions is to determine the direction of the move. 28 D T Midstream is trading approximately -2 shy of a 5815 entry.

Voestalpine had a return on equity of 1473 and a net margin of. In fact some great research has recently shown that the analysts are just piggybacking on the prior news that has come out from the company and adjusting their earnings from that. The best stock analysis software for investors is Stock Rover as it specializes in deep fundamental financial screening research reports and portfolio management.

D T Midstream With its next quarterly earnings report due around Apr. February 6 2013 Order Reprints Print Article Its earnings season a time when we can discover not just how Corporate America is. The news was the actual originator of the information and the analyst just adjusted to it.

Read full article. NYSENET Expected to Post Quarterly Sales of 20574 Million. Bernstein downgraded the stock to Market Perform from Outperform and has a 57 price targetThe 52-week trading range is 5260 to 8637 and shares traded near 72 apiece on.

Decision usefulness is an ex ante concept but tests regarding the usefulness of earnings for stock price generally have used actual not expectational data. Analysts might predict the managed earnings number rather than the unmanaged one because like other investors they are not sufficiently sophisticated or they lack the information needed to project and undo the effects of earnings management. The Best Earnings Bets.

The Most Accurate Way to Predict Earnings This Quarter. N 30 A colleague suggests that he can improve on his. To predict earnings Wall Street analysts use several techniques.

Exclusive To the Bad News Bears. 11 hours agoEquities Analysts Offer Predictions for Abbott Laboratories Q2 2022 Earnings NYSEABT Cloudflare Inc. 04 2016 441 PM ET CVX MCD WMT.

3 hours agoLKQ Corporation LKQ Quick Quote LKQ - Free Report is slated to release first-quarter 2022 results on Apr 28 before market open. Decide on Hedging or Leveraging. This has resulted in an Earnings ESP of 0On the other hand the stock currently carries a Zacks Rank of 2So this combination makes it.

There is Good News on the Way. The analyst has a success rate of a whopping 85 with an average return of 225 over the past year. It is the ideal platform for dividend investing value stock investing and long-term growth investing because according to our testing it has the best 10-year historical fundamental database on the market.

While we only really have access to. 1 Look at historical results 2 Identify the factors that influenced those results 3 Make forward looking assumptions on those factors based on any combination of secondary research primary research incl. Return -3333 357PE - 359PS.

Or analysts might choose to.

How To Use Options To Make Earnings Predictions

Analysts Do A Great Job Predicting The Past The Future Not So Much Seeking Alpha

Analysts Do A Great Job Predicting The Past The Future Not So Much Seeking Alpha

0 Response to "Which Analyst Is the Best on Predicting the Earnings"

Post a Comment